Should You Pay Off Your Mortgage Before Retirement? The Answer Might Surprise You

The Question Everyone Asks

"Should I pay off my mortgage before I retire?"

I hear this question constantly from clients approaching retirement. The conventional wisdom is clear: "Going into retirement with debt is irresponsible. Pay off the mortgage first."

But recently, a client asked me something that cut deeper:

“We're concerned our mortgage payments will affect our retirement lifestyle. We want to travel and help fund our grandkids' college, but we're worried we're stretching too thin with a mortgage payment. Do we need to work longer just to pay off the house first? Is a mortgage really a retirement killer?”

Here's what I told them—and what the math actually shows.

The Problem: Conventional Wisdom vs. Financial Reality

What Conventional Wisdom Says

"Pay off all debt before retirement. A mortgage-free retirement is the only way to have financial security."

What the Numbers Actually Show

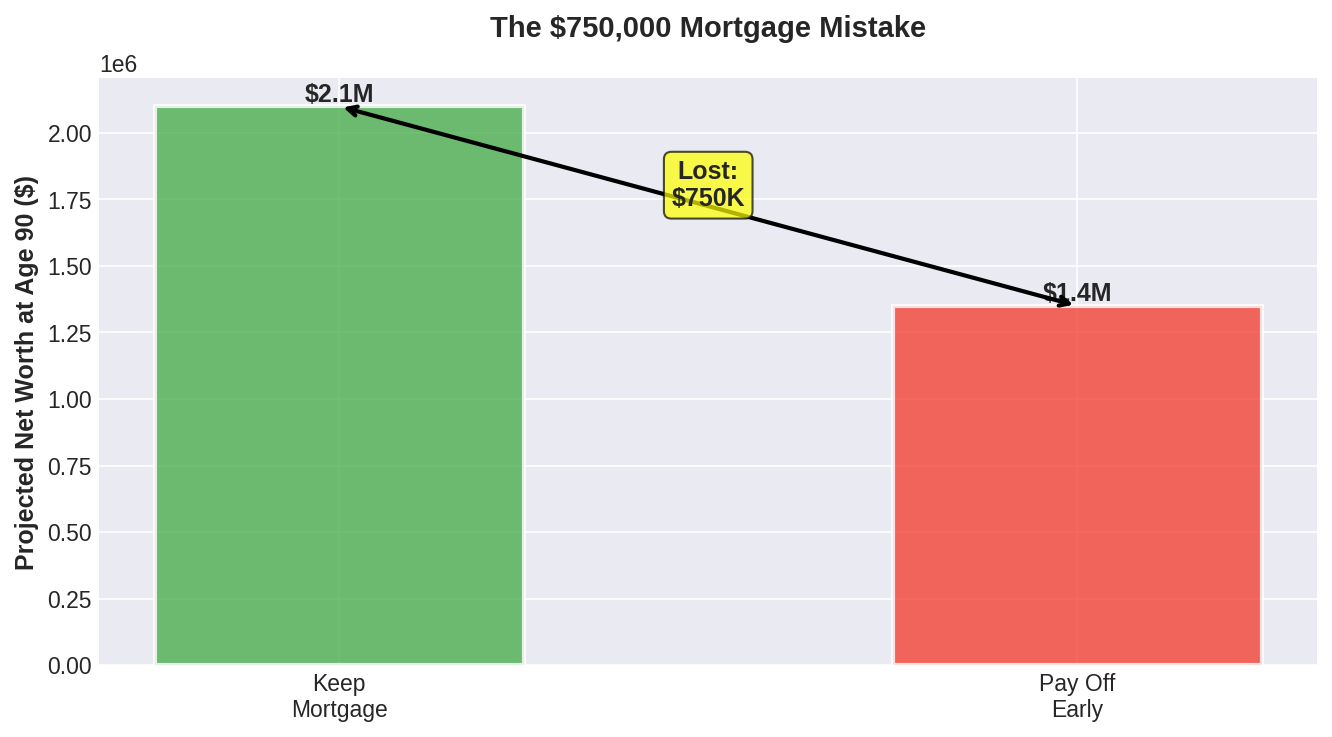

For many retirees, paying off a mortgage early can cost hundreds of thousands of dollars and actually reduce financial security in retirement.

Let me show you a real example.

Real-World Case Study: The $750,000 Mortgage Mistake

The Client Situation

Profile:

• Married couple approaching retirement

• Net worth: $2.5M (including home)

• Liquid assets: $1.8M (TSP, 401k, brokerage accounts)

• Monthly mortgage: $3,000

• Total monthly expenses: $10,000

• Home value: $700,000

• Mortgage balance: $350,000

The Question: Should they pay off the $350,000 mortgage with a lump sum from their portfolio?

The Results

Paying off the mortgage early cost this couple $750,000 and dramatically increased the risk of running out of money in their 70s.

Why This Happens: The Three Hidden Costs

Hidden Cost #1: Opportunity Cost

The mortgage interest rate: 3.5%

Balanced portfolio return: 6-7% annually

The spread between investment returns and mortgage interest compounds dramatically over time. That $350,000 invested at 6% grows to $1,121,000 over 20 years. Used to pay off the mortgage? It only saves you $180,000 in interest.

Opportunity cost: $941,000

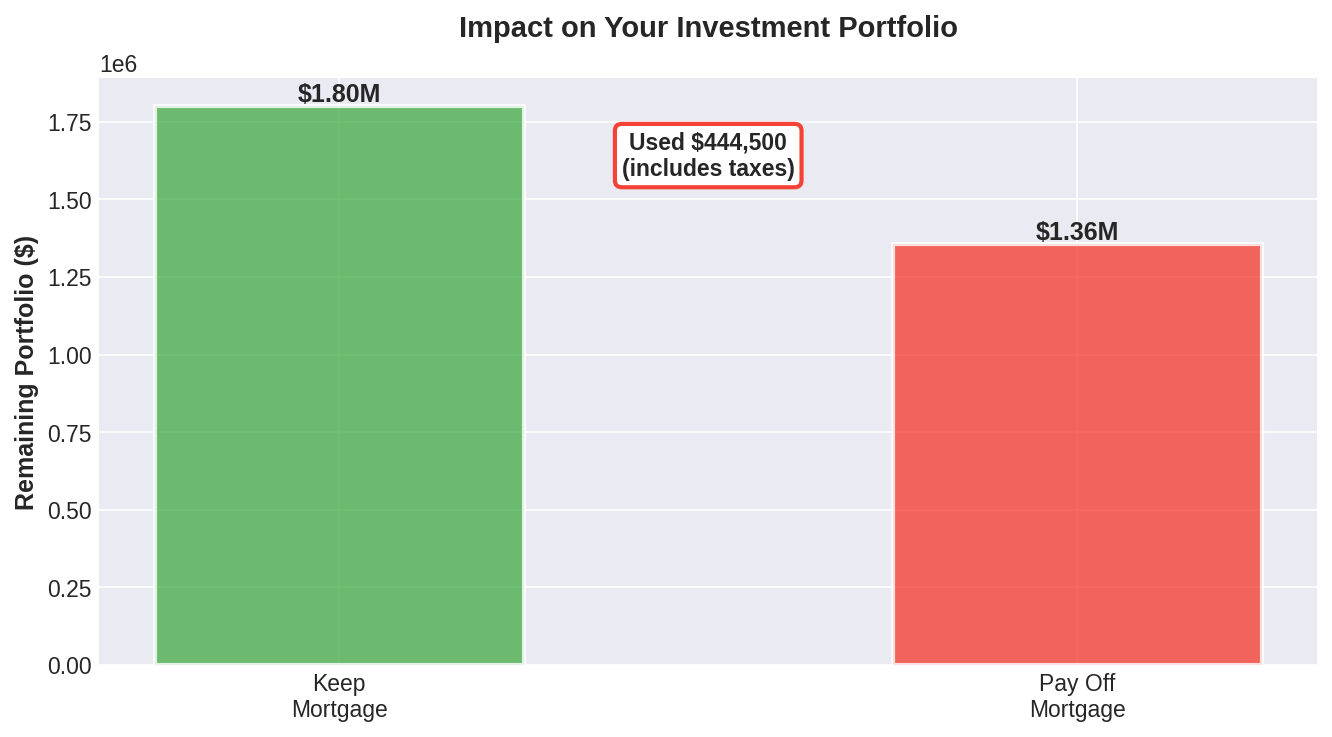

Hidden Cost #2: Tax Impacts

Paying off a $350,000 mortgage requires withdrawing more than $350,000 from tax-deferred accounts.

To net $350,000 for the mortgage payoff:

• Mortgage payoff needed: $350,000

• Federal taxes (22%): +$77,000

• State taxes (5%): +$17,500

• Total TSP withdrawal required: $444,500

This also pushes you into higher tax brackets, may trigger IRMAA Medicare surcharges, and reduces future compounding potential on that entire amount.

Hidden Cost #3: Reduced Liquidity

Once you pay off the mortgage, that $350,000+ is locked in your home's equity.

What happens when you need cash?

• Market downturn: With a mortgage, you can stop extra principal payments and preserve cash. Without one, you can't easily access home equity.

• Medical emergency: With liquid reserves available vs. needing an expensive HELOC.

• Long-term care: Flexible asset allocation vs. potentially having to sell your home.

• Opportunity to help kids: Cash available vs. home equity trapped.

Home equity is the least liquid, least flexible asset in your portfolio.

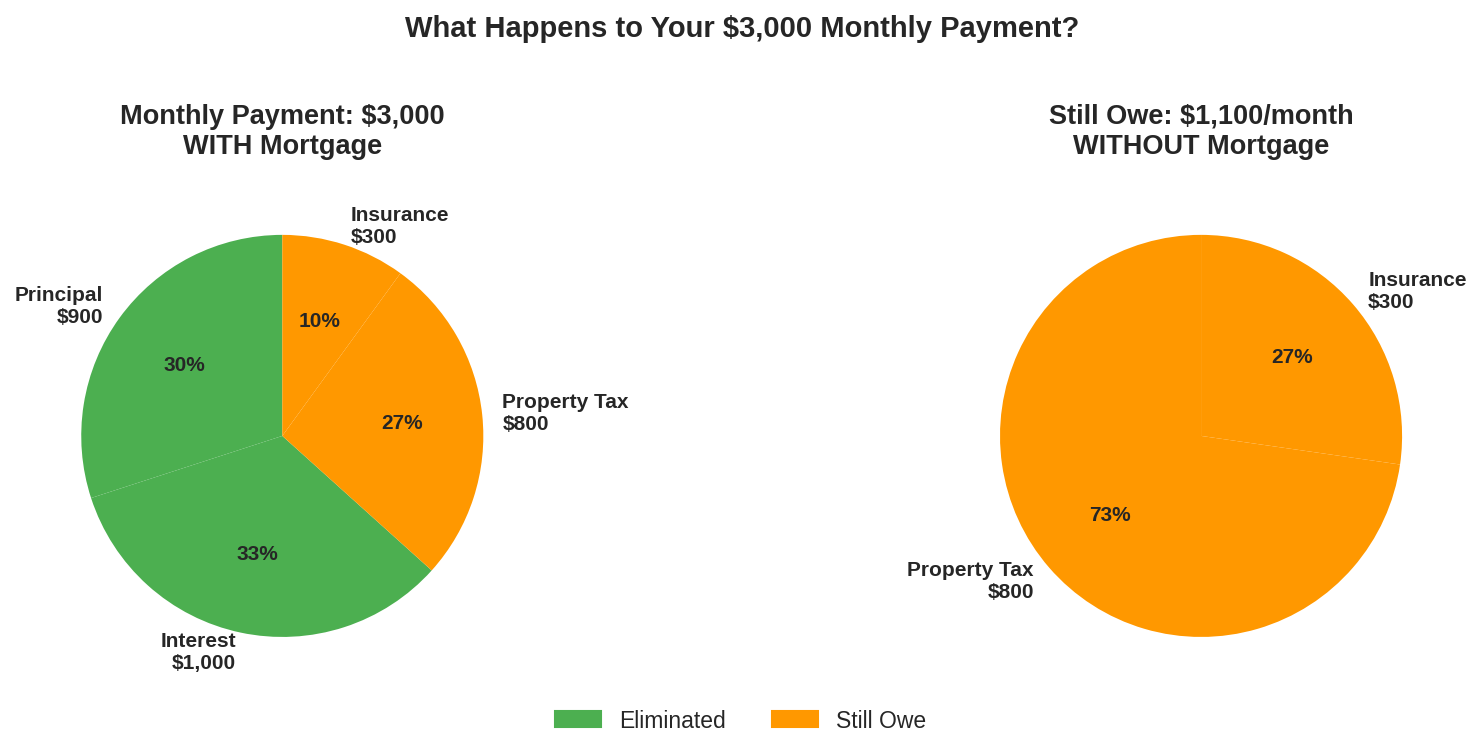

What Most People Miss: Your Mortgage Payment Isn't All Debt

Your monthly mortgage payment isn't just your loan. It's made up of four components: Principal, Interest, Taxes, and Insurance (PITI).

Paying off your mortgage only eliminates $1,900 of your $3,000 payment.

Don't forget ongoing costs even with no mortgage:

• Property taxes and insurance: $13,200/year

• HOA fees: Often $200-500/month

• Maintenance and repairs: 1-2% of home value annually ($7,000-$14,000 for a $700K home)

For a $700,000 home: Expect $20,200-$27,200 in ongoing annual costs even with no mortgage.

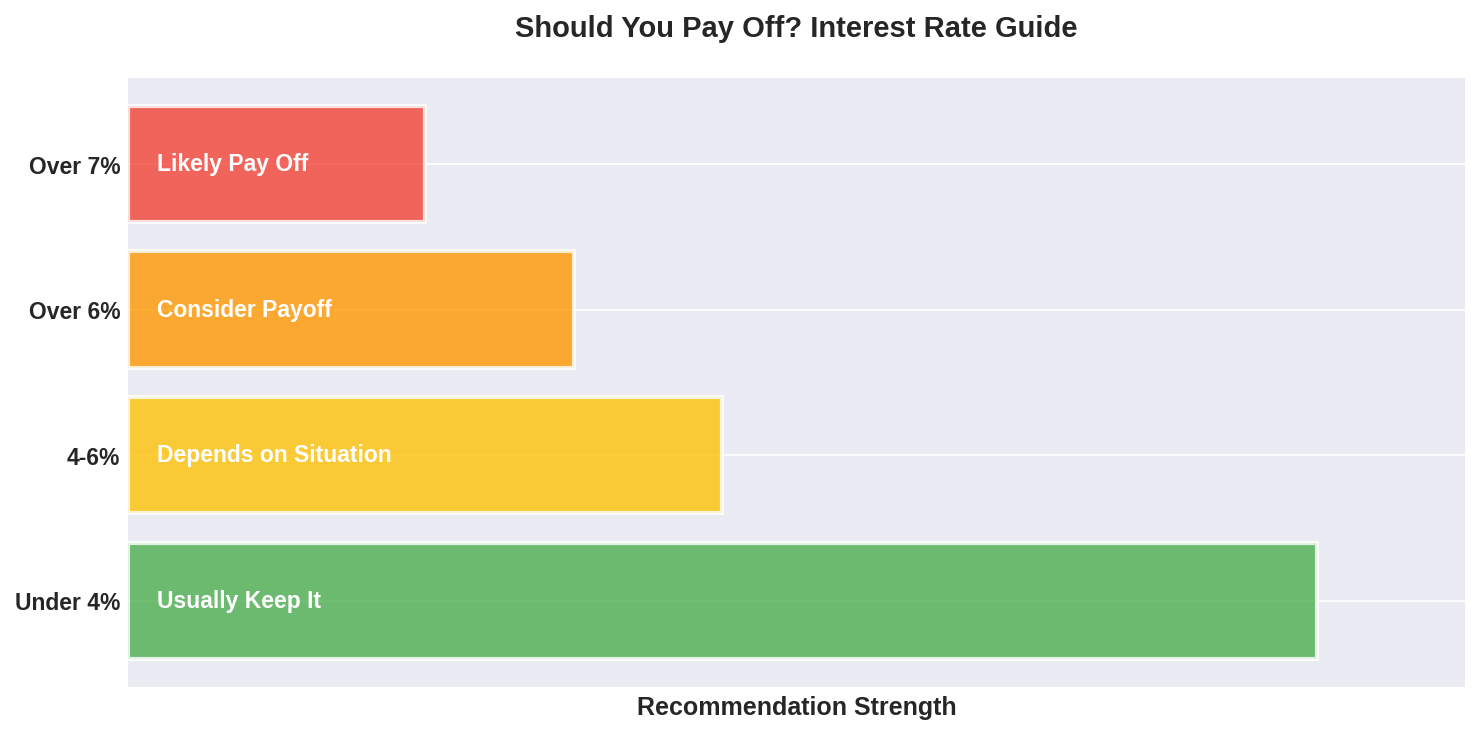

When Paying Off Your Mortgage DOES Make Sense

Despite the math favoring keeping the mortgage, there are legitimate situations where paying it off makes sense:

Scenario 1: High Interest Rate

If you refinanced in 2020-2021, you likely have a 2.5-3.5% rate. Keep it.

Scenario 2: Pension + Social Security Cover All Expenses

If your guaranteed income (FERS pension + Social Security) covers all your expenses including the mortgage, you have more flexibility to pay it off using excess portfolio assets without endangering your plan.

Scenario 3: Very Large Portfolio Relative to Mortgage

Rule of thumb: If paying off the mortgage requires more than 20% of your liquid net worth, the opportunity cost is likely too high.

Examples:

• $3M portfolio, $350K mortgage (11.7%): More flexibility to pay off

• $1M portfolio, $350K mortgage (35%): Usually keep mortgage

• $500K portfolio, $350K mortgage (70%): Definitely keep mortgage

Scenario 4: Severe Psychological Stress

This is legitimate. Some people grew up during the Great Depression, experienced foreclosure, or have deep-seated beliefs about debt. Financial planning isn't purely mathematical—it's also psychological.

However, before making an emotional decision:

1. Run the numbers first to understand the cost

2. Consider a middle ground (pay extra principal, but not lump sum)

3. Explore why you feel this way (sometimes education reduces anxiety)

4. Calculate the "peace of mind premium" you're paying

If paying off the mortgage costs you $400,000 over retirement, but gives you genuine peace of mind, that's a trade-off you might consciously choose. Just make it with eyes open.

The Better Strategy: Strategic Mortgage Management

Instead of all-or-nothing, consider these optimized approaches:

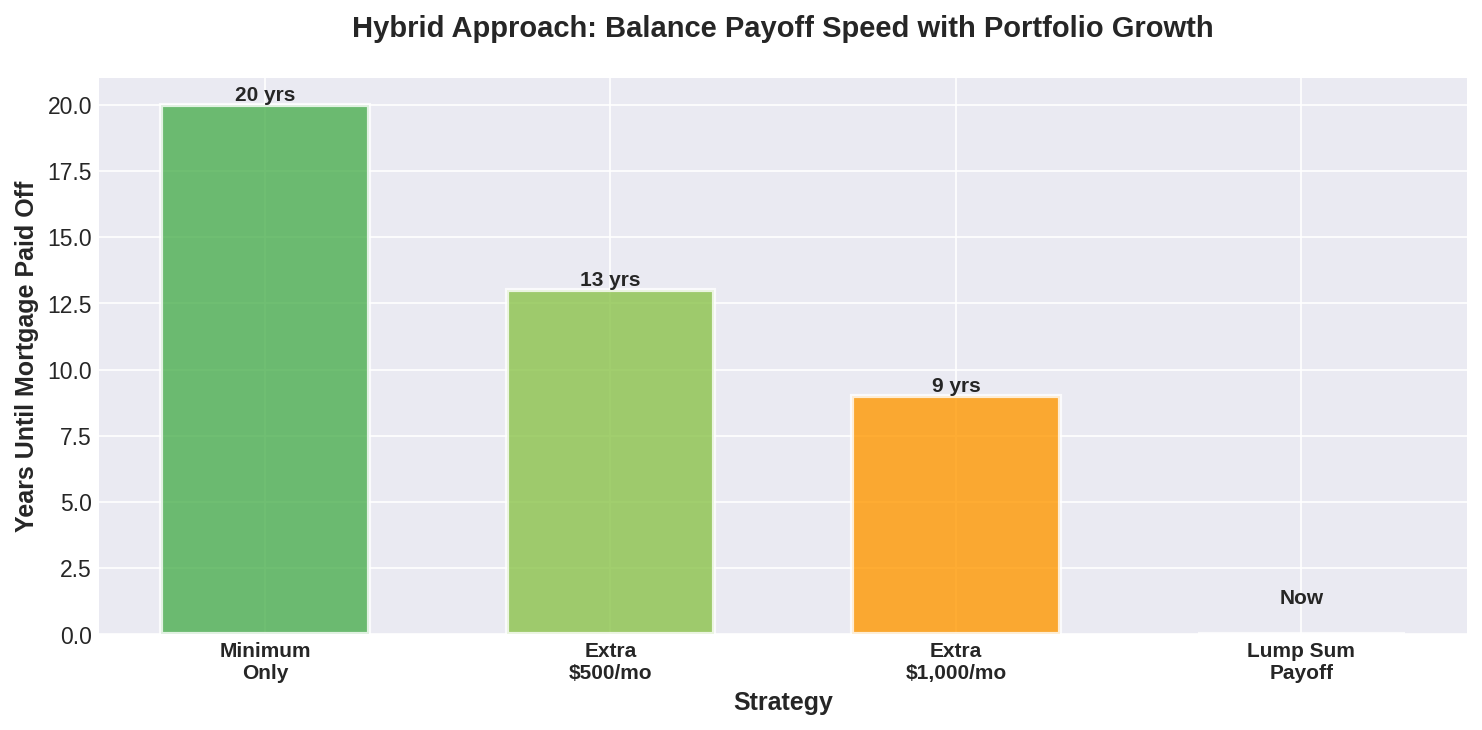

Strategy 1: The Hybrid Approach

Make extra principal payments gradually instead of lump sum payoff.

The hybrid approach:

• Accelerates payoff without destroying portfolio

• Maintains liquidity

• Preserves compounding potential

• Provides psychological progress toward "debt-free"

Strategy 2: Time-Based Payoff Strategy

Align mortgage payoff with retirement phases:

Pre-retirement (55-62): Pay minimum, maximize savings. Build portfolio for retirement.

Early retirement (62-70): Pay minimum or extra principal. Portfolio needs growth, markets volatile.

Mid retirement (70-75): Accelerate payoff. Social Security started, portfolio established.

Late retirement (75+): Target mortgage-free. Reduce complexity, lower expenses.

This balances portfolio growth when it matters most with debt reduction as retirement stabilizes.

Strategy 3: Portfolio Allocation Adjustment

Instead of paying off mortgage, adjust portfolio risk to provide mortgage payment security:

• Mortgage payment fund (3 years): $108,000 in bonds/cash → Covers $3,000/mo × 36 months

• Near-term reserves (Years 4-7): $144,000 in balanced funds → Low-moderate risk

• Long-term growth: Remainder in diversified portfolio → Compounding potential

This provides mortgage payment security without sacrificing $350,000+ in opportunity cost.

Making the Right Decision for Your Situation

Keep the mortgage if:

✓ Mortgage rate is under 4%

✓ Paying off requires >20% of portfolio

✓ Conservative investment returns exceed mortgage rate

✓ You have adequate liquidity for emergencies

✓ Your retirement plan success rate is strong with mortgage

Consider paying it off if:

✓ Mortgage rate is over 6%

✓ Guaranteed income (FERS + SS) covers all expenses including mortgage

✓ Mortgage is <10% of total portfolio

✓ You have severe psychological stress about debt

✓ You've run the numbers and accept the opportunity cost

Consider the middle ground if:

✓ The math favors keeping it, but you're emotionally uncomfortable

✓ You want progress toward debt-free without portfolio damage

✓ Your situation doesn't clearly favor either extreme

The Bottom Line

For most federal employees approaching retirement with low-rate mortgages (under 4%), keeping the mortgage and investing the difference makes more financial sense than paying it off.

But this isn't just about math. It's about:

• Your specific financial situation

• Your guaranteed income sources

• Your portfolio size relative to the mortgage

• Your risk tolerance and sleep-at-night factor

• Your long-term goals for your estate and family

The worst decision is making an emotional choice without understanding the numbers. The best decision is understanding the math AND your values, then choosing consciously.

At Allset Wealth, we help federal employees run these numbers for their specific situation. Because retirement planning isn't one-size-fits-all—it's personal.

Want to see what the numbers look like for your situation? Let's talk.

Disclaimer: This article is for educational purposes only and does not constitute investment, tax, legal, or insurance advice. Mortgage decisions involve complex factors including interest rates, tax implications, investment returns, and personal circumstances. Any strategies discussed may not be suitable for every individual. Consult your financial advisor, tax professional, and/or attorney regarding your specific situation before making any financial decisions. Past performance is not indicative of future results.