The 5 Biggest Federal Retirement Mistakes And How to Avoid Them

Look, I'm going to be straight with you. After watching federal employees navigate retirement for years, I've seen the same mistakes happen over and over. And honestly? They're heartbreaking because they're completely avoidable.

The thing about retirement mistakes is that you can't take them back. Miss a critical deadline or make the wrong election, and you could be looking at a six-figure loss over your lifetime. No pressure, right?

But here's the good news: these mistakes follow patterns. Once you know what to watch for, you can sidestep them completely. So let's dive into the five most common ways federal employees accidentally leave money on the table—and more importantly, how you can avoid them.

Mistake #1: Planning Like You'll Only Live 20 Years in Retirement

Here's what usually happens: You're planning to retire at 62, maybe live until 82. Sounds reasonable. Twenty years of retirement. Done.

Except... what if you're wrong?

If you and your spouse are in decent health, there's about a 70% chance one of you will make it into your 90s[^1]. That's not 20 years of retirement—that's 30 to 35 years. And here's the kicker: if you plan for 20 years but need 30, you could be looking at an $800,000 shortfall. And that's before we even talk about long-term care, which can run $100,000 per year.

What to do instead: Break retirement into phases

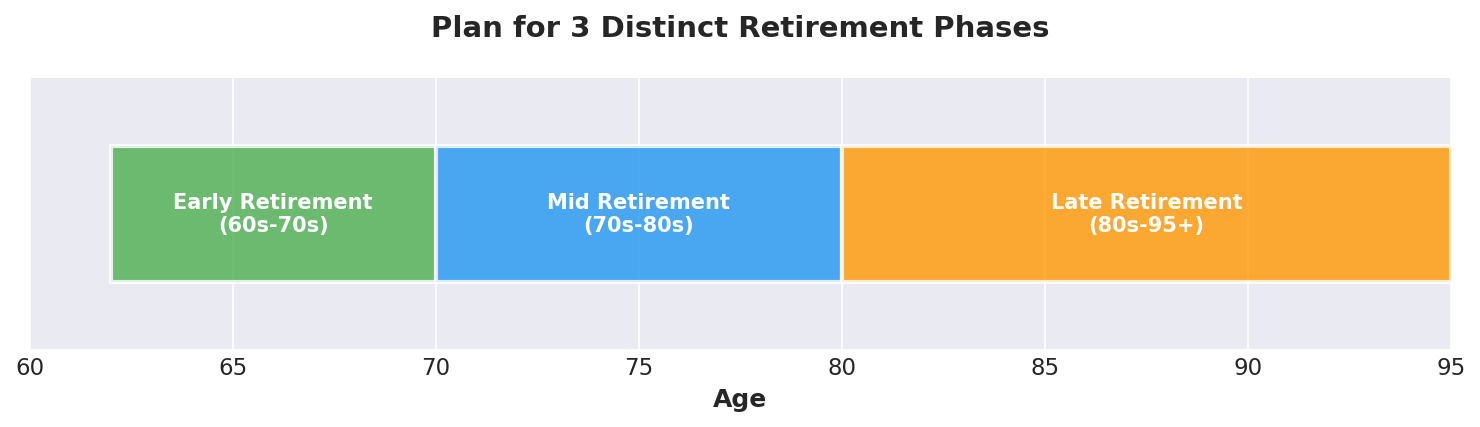

Stop thinking about retirement as one big chunk of time. Your 60s are different from your 80s, right? Your spending, your health, your needs—they all change. So your planning should reflect that.

Your 60s and early 70s (the "go-go" years): This is when you're traveling, staying active, maybe helping the grandkids. You're spending more. You need money that's accessible and somewhat conservative because you'll be tapping it regularly.

Your mid-70s to early 80s (the "slow-go" years): Things usually settle down a bit. You're not traveling as much. Healthcare becomes more important. You want steady income and moderate growth.

Your 80s and beyond (the "no-go" years): This is when long-term care costs might hit. Spending typically drops except for healthcare and potential care needs. (Read more here: 3 Stages of Retirement (Go-Go, Slow-Go, No-Go)

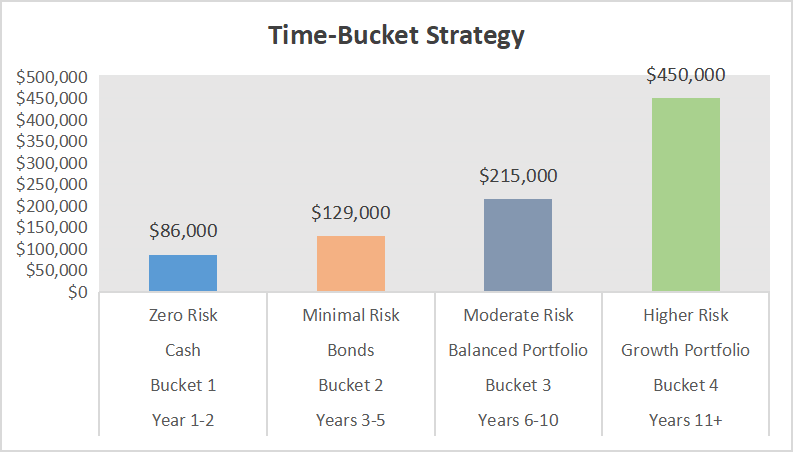

The strategy that actually works? Think of your money in buckets:

Bucket 1 (Years 1-5): Keep this in cash and super-safe stuff. G Fund, money market, savings accounts. If the market crashes tomorrow, you don't care because you're not touching your stocks.

Bucket 2 (Years 6-15): This is your balanced bucket. Mix of stocks and bonds through the F Fund and maybe some C and S Fund. Growing a bit, but not wild.

Bucket 3 (Years 16-30+): Here's where you can be more aggressive. This money has decades to recover from any downturn, so it can handle more stock exposure.

This way, you never have to sell stocks when they're down. You've always got that cash cushion. No panic selling during the next market crash.

Mistake #2: Not Really Understanding Your Federal Benefits

FERS is complicated. There, I said it. You've got your pension, your TSP, Social Security, FEGLI life insurance, health insurance, survivor benefits—it's a lot. And a bunch of these decisions are permanent once you retire.

Let me hit the big ones people get wrong:

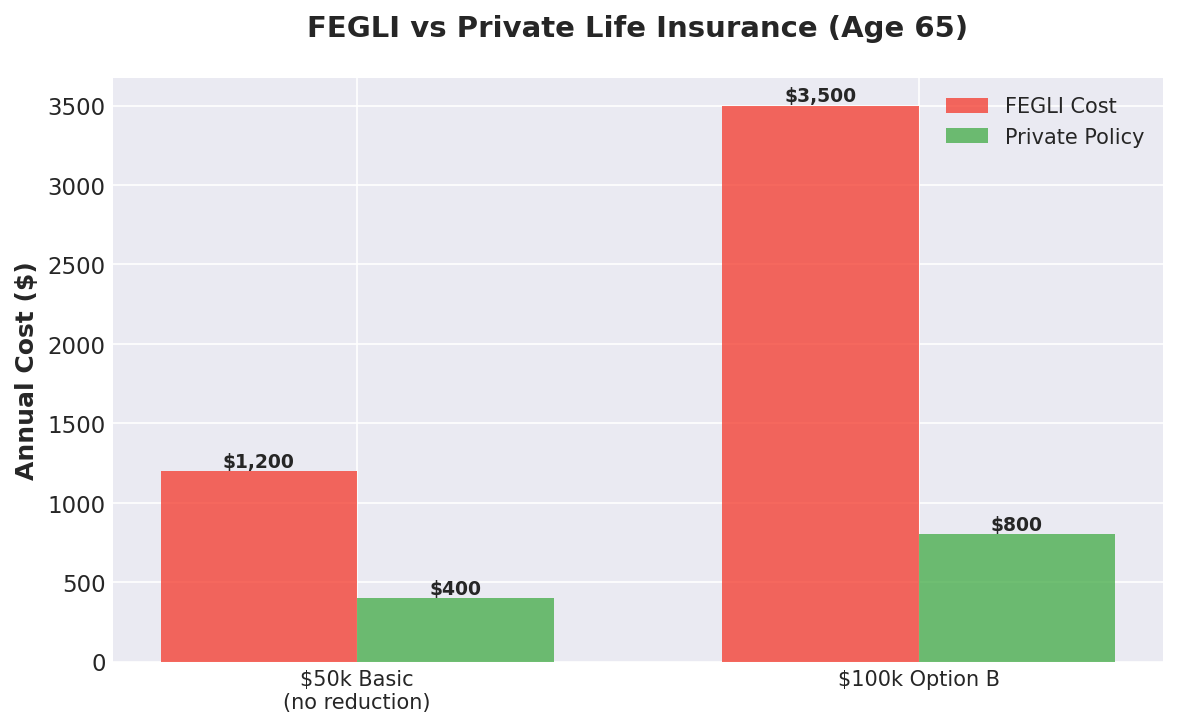

FEGLI gets insanely expensive after retirement

That life insurance through work? It's a decent deal while you're working. After retirement? The costs go through the roof.

The premium is only for reference.

Check this out: if you're 65 and keeping $50,000 in Basic FEGLI without the reduction option, you might be paying $1,200 a year. You could get a private term policy for $400. Over 20 years, that's $16,000 down the drain. And if you're carrying Option B coverage? You could be wasting $54,000 or more.

What should you do? About 2-3 years before retirement, shop around for private life insurance. Get approved first—don't drop FEGLI until you have something else locked in. And honestly? Think hard about whether you even need life insurance anymore. If your spouse has their own FERS pension and you've got decent assets, maybe you don't.

One trick that makes sense: keep the Basic FEGLI with the 75% reduction option. It'll cost you like $10 a month and gives you funeral coverage. That's actually worth it.

Missing service records will haunt you forever

Every year of federal service you can't prove? That's roughly $1,000 less per year in pension. Over a 30-year retirement, that's $30,000 you're just... not getting.

Six to twelve months before you retire, request your complete personnel file (eOPF) and go through it with a fine-tooth comb. Check every job, every military service credit, make sure your high-3 salary calculation is right. Save everything to your personal computer because once you leave federal service, fixing this stuff becomes a bureaucratic nightmare.

Seriously, I've seen people spend years trying to get corrections made after they've already retired. Don't be that person. Fix it while you still have access to HR and all your records.

Mistake #3: Using the Same TSP Strategy in Retirement That You Used While Working

Here's the thing everyone gets wrong: what got you TO retirement won't get you THROUGH retirement.

The C Fund has been phenomenal for decades. I get it. You've probably made a lot of money in it. But when you're retired and actually withdrawing money, everything changes. Market volatility becomes your enemy, not your friend.

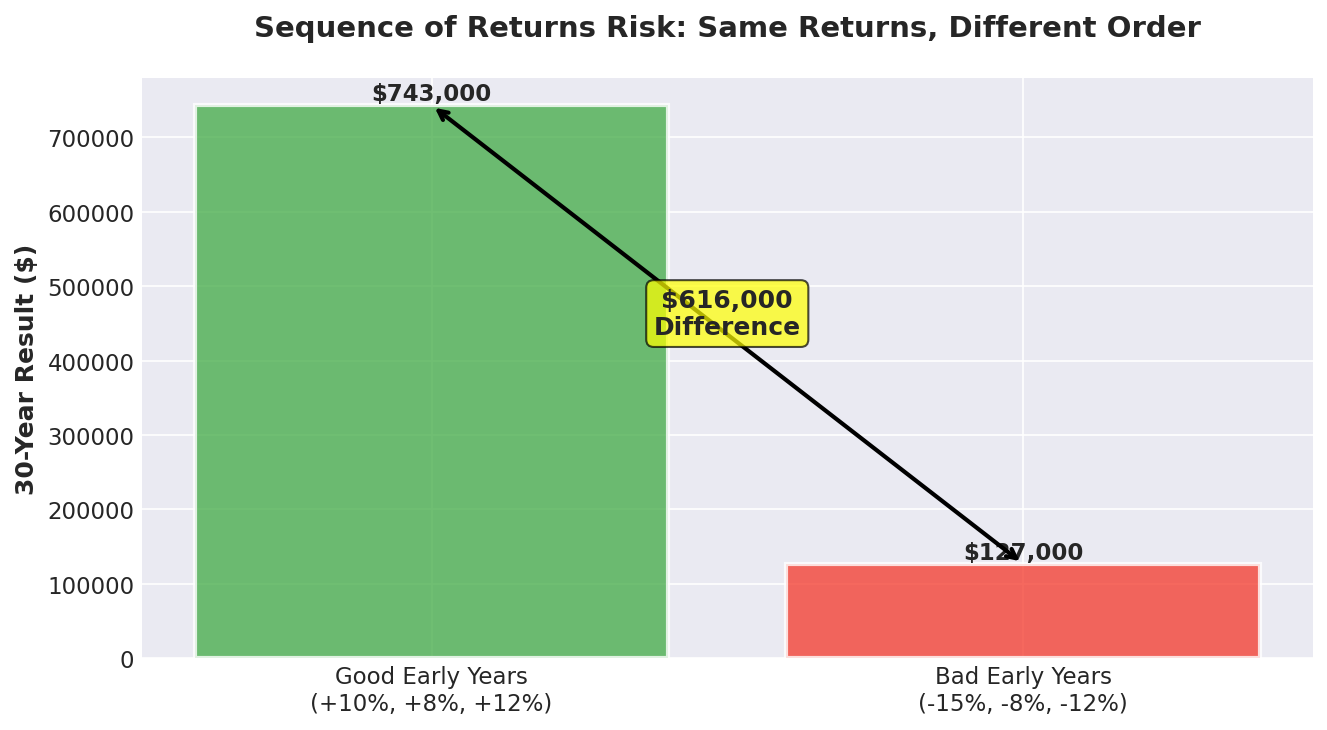

Let me show you why this matters. Imagine two people with identical portfolios, identical average returns over 30 years. The only difference? The order of those returns. One person gets good returns early in retirement. The other person hits a nasty bear market right after retiring.

Same average returns. Same portfolio. Person A ends up with $743,000. Person B ends up with $127,000. That's a $616,000 difference just because of when the bad years happened.

This is called "sequence of returns risk," and it's the silent killer of retirement accounts.

Here's how to protect yourself

You need to shift your TSP allocation as you get closer to retirement and during those critical first 10 years:

5-10 years before retirement: Start moving toward 60-70% stocks, 30-40% bonds/G Fund. You're reducing volatility.

1-3 years before retirement: Get more conservative. Maybe 50% stocks, 50% fixed income. You're preparing for the big transition.

First 10 years of retirement: This is the danger zone. Stay around 40-50% stocks, 50-60% bonds and G Fund. Protect yourself during those critical early years.

After 10 years retired: You can actually increase stocks again if you want. You've made it through the highest-risk period.

Mistake #4: Trying to Time the Market

"Why don't we just sell when the economy looks bad and buy when it looks good?"

I hear this all the time. And I get it—it seems logical. But if anyone could actually do this consistently, they'd be billionaires. Warren Buffett would be asking them for tips.

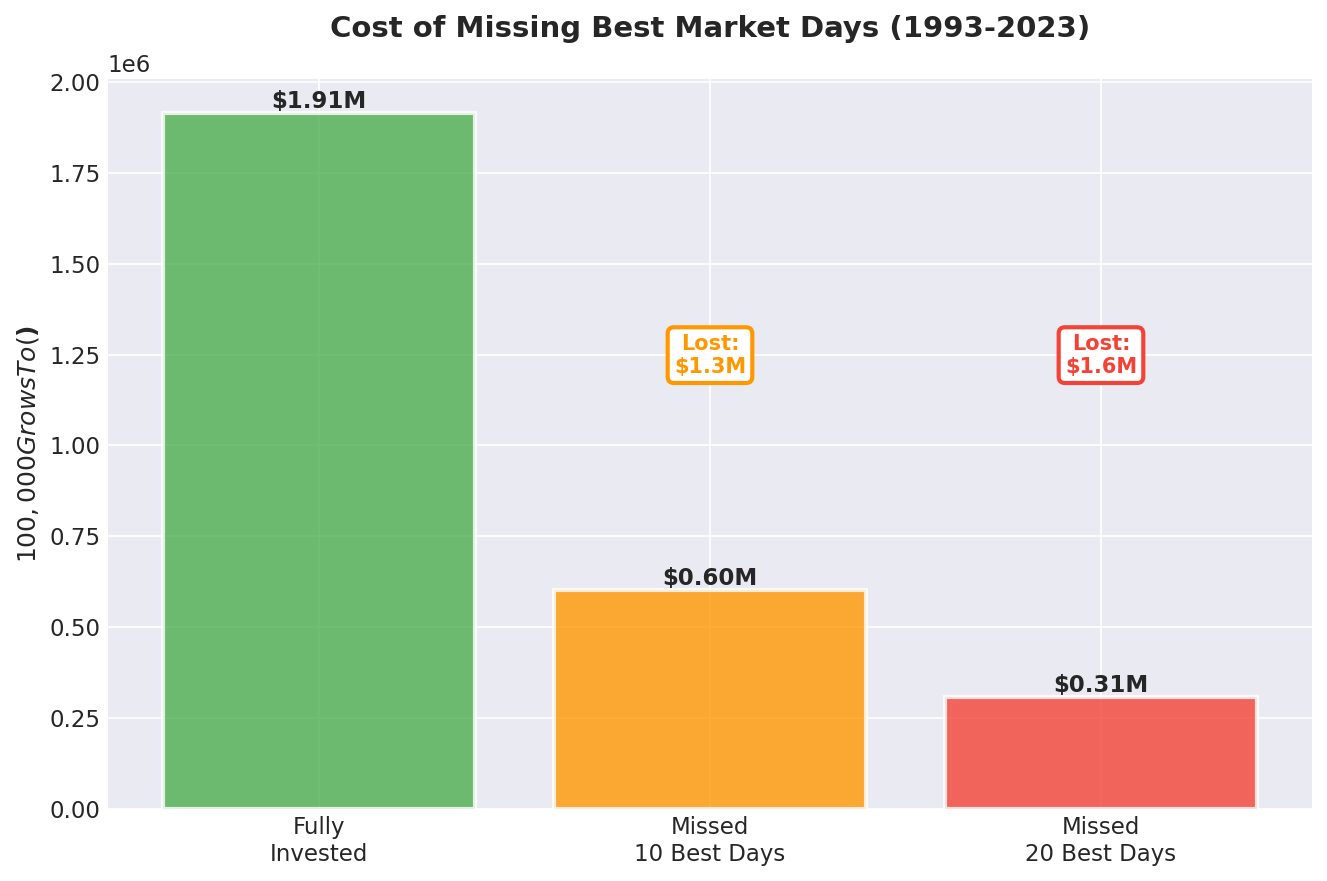

Here's what actually happens when you try to time the market: you miss the best days. And missing just a few of the best days absolutely destroys your returns.

Between 1993 and 2023, if you stayed fully invested, $100,000 would have grown to $1,913,000. But if you missed just the 10 best days trying to "wait for things to settle down," you'd have only $602,000. That's a loss of $1.3 million.

Miss 20 best days? You're down to $308,000. You've lost $1.6 million.

And here's the really frustrating part: most of those best days happen right after the worst days. So when you sell during a crash to "wait for recovery," you almost always miss it.

Build your portfolio around when you need the money, not market predictions

Instead of trying to predict the market, just figure out when you need the money and invest accordingly.

First, calculate your income gap. Let's say: FERS pension ($45,000/year) + Social Security if you wait until 70 ($32,000/year) = $77,000/year total guaranteed income.

But you need $120,000/year to live comfortably. That means you need $43,000/year from your TSP.

Every year, you refill Bucket 1 from Bucket 2. When markets are up, you refill from stocks (selling high). When markets are down, you refill from bonds (preserving your stocks for recovery). Zero emotion. Zero timing decisions. Zero panic when the market drops.

Mistake #5: Treating Each Income Source Like It's Independent

This is where people really leave money on the table. You've got FERS, Social Security, TSP, maybe taxable accounts, maybe a spouse's income. Most people optimize each one separately. Big mistake.

When you don't coordinate these, you end up taking Social Security too early and losing $15,000/year for life, making TSP withdrawals that push you into higher tax brackets, missing opportunities for Roth conversions, and triggering Medicare surcharges you could have avoided.

Over 25 years, poor coordination can cost you $775,000. That's not a typo.

Here's how to do it right

Optimize when you take Social Security

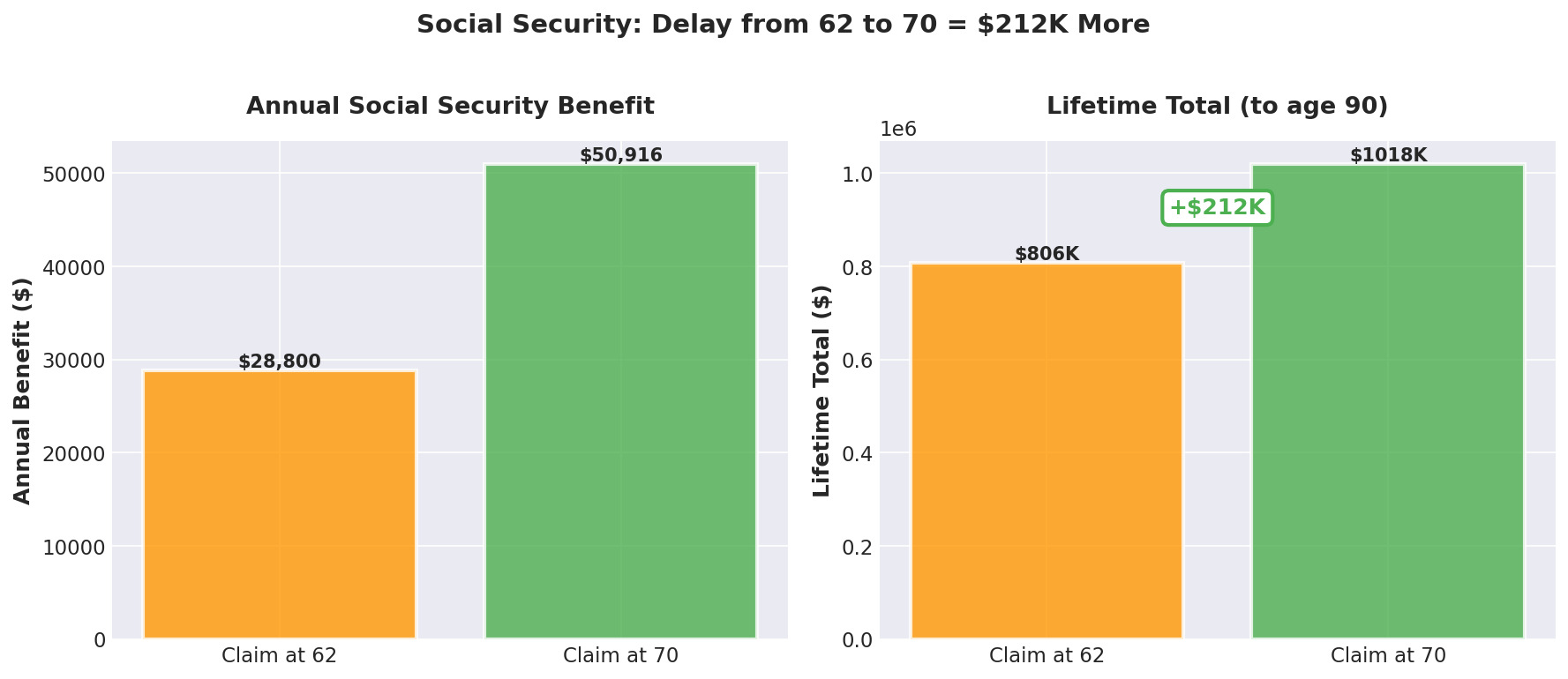

For most federal employees, delaying Social Security to 70 makes a ton of sense. Your FERS pension and TSP can cover your needs in the meantime, and waiting gets you a 24% bigger benefit for life.

Look at the math: if you claim at 62, you might get $28,800/year. Over 28 years (to age 90), that's $806,400. But if you wait until 70, you get $50,916/year. Over 20 years (to age 90), that's $1,018,320.

Waiting from 62 to 70 puts an extra $211,920 in your pocket if you live to 90.

Use those bridge years for Roth conversions

Between 62 and 70, before you claim Social Security, your income is lower. This is your golden opportunity for Roth conversions.

Here's an example: FERS Pension ($45,000) + TSP Withdrawal ($20,000) + Roth Conversion ($30,000) = Total income of $95,000 (staying in the 12% tax bracket).

Do this for 8 years, and you've moved $240,000 into Roth at a low tax rate.

Why does this matter? Because all future Roth growth is tax-free. Roth withdrawals don't count toward Medicare means testing (IRMAA). There are no required minimum distributions on Roth accounts. And your heirs get tax-free inheritance.

The Bottom Line

You've spent 30+ years building up these federal benefits. They're excellent benefits—honestly some of the best retirement packages out there. But only if you understand how they work and avoid these common mistakes.

The difference between getting this right and getting it wrong? We're talking hundreds of thousands of dollars over your retirement. Maybe more.

The good news is that you don't have to figure this all out alone. Start with this guide. Take it one step at a time. And if you need help, talk to someone who specializes in federal retirement. This is too important to wing it.

You've worked hard for this retirement. Make sure you get every dollar you've earned.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, tax, legal, or insurance advice. Federal benefits, tax laws, and regulations are subject to change. Any strategies discussed may not be suitable for every individual and may involve risks, including the possible loss of principal. Please consult your financial advisor, tax professional, and/or attorney regarding your specific situation before making any financial decisions. Past performance is not indicative of future results.

[^1]: Society of Actuaries Longevity Illustrator and Social Security Administration Period Life Tables, 2024 data