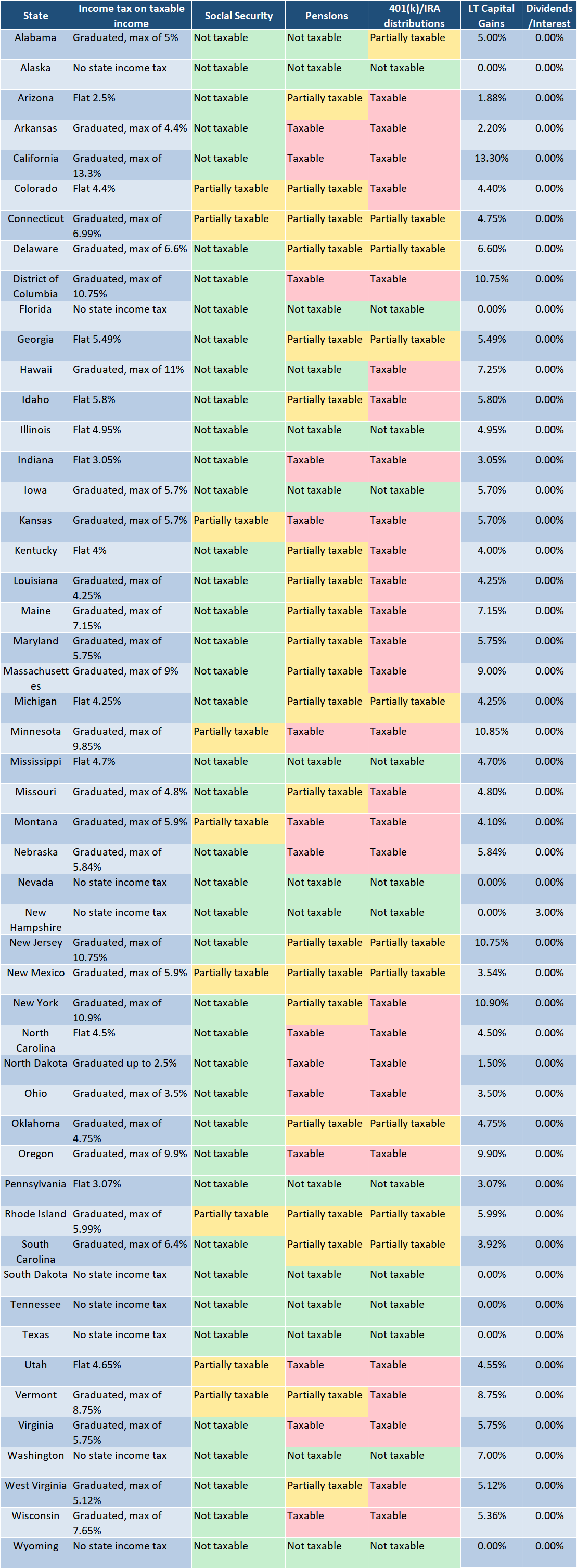

Retirement Taxes by State: How Every State Taxes Social Security, Pensions, and IRA/401(k) Withdrawals?

When people ask, “Where should I retire for taxes?”, they’re usually thinking about one thing—state income tax. But retirement taxes are a package deal: states can tax (or exempt) Social Security, pensions, IRA/401(k) withdrawals, investment income, and then make up revenue elsewhere with property tax and sales tax.

The 5 retirement income “buckets” states tax differently

Before you compare states, separate your income into buckets:

Social Security

Pensions (private + government; sometimes military is different)

401(k) / IRA distributions

Wages (if you’ll work part-time in retirement)

Interest/dividends/capital gains (brokerage accounts)

Most states mix-and-match exemptions and deductions across these buckets—so two retirees in the same state can have totally different outcomes.

Start here: the “big 3” questions retirees ask (and why they matter)

1) Does the state tax Social Security?

Many states do not tax Social Security, but some do—often with income-based phaseouts (meaning higher-income retirees may still pay).

Example:

Colorado taxes Social Security in some cases, but allows larger deductions/exclusions based on age and income, and has a 4.4% flat income tax.

Connecticut doesn’t tax Social Security for many retirees under certain AGI thresholds (and has moved toward broader relief).

2) Does the state tax IRA/401(k) withdrawals?

This can be your largest “tax lever” because withdrawals can be big (especially after RMDs).

Examples from the guide:

Alabama: first $6,000 of retirement-plan distributions may be exempt for age 65+.

Arkansas: deduction up to $6,000 of eligible retirement income for age 59½+.

Illinois: generally exempts retirement income from state tax (but note estate tax considerations).

3) Does the state tax pensions?

Some states exempt government pensions but tax private pensions, or exempt both.

Examples:

Pennsylvania: doesn’t tax many “traditional” retirement income types (per the guide).

Wisconsin: Social Security not taxed; some government retirement income can be exempt for eligible retirees.

“No income tax” states: simple headline, not always simple outcome

As of 2026, nine states are commonly cited as having no personal state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming.

That usually means your Social Security, pension, and IRA/401(k) withdrawals won’t face state income tax.

Examples highlighted in the guide:

Florida: no personal income tax; retirement income not taxed at the state level.

Wyoming / South Dakota / Tennessee / Alaska: no personal income tax in the guide’s state summaries.

Important nuance: states without income tax may rely more on sales tax, property tax, special excise taxes, etc. So “tax-friendly” depends on your spending style (homeowner vs renter, high spender vs low spender).

Below is an state-by-state snapshot (alphabetical) based on Kiplinger’s “Retirement Taxes: How All 50 States Tax Retirees” guide, covering all 50 states plus Washington, D.C.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, tax, legal, or insurance advice. Any strategies discussed may not be suitable for every individual and may involve risks, including the possible loss of principal. Please consult your financial advisor, tax professional, and/or attorney regarding your specific situation before making any financial decisions. Past performance is not indicative of future results.