How Much Money Do I Need to Retire as a Federal Employee? (FERS + TSP + Social Security) — 2026 Guide

It's the question that keeps you up at night: "Do I have enough?"

You've been contributing to your TSP for 20, maybe 30 years. Your FERS pension is building. You're getting close to retirement age. But nobody's ever given you a straight answer about the actual number you need.

So let me give you one.

The truth is, there's no single magic number that works for everyone. But there is a systematic way to calculate your specific number. And I'm going to show you exactly how to do it.

The Quick Answer (Then We'll Get Into the Details)

For most federal employees, here's the rough guideline:

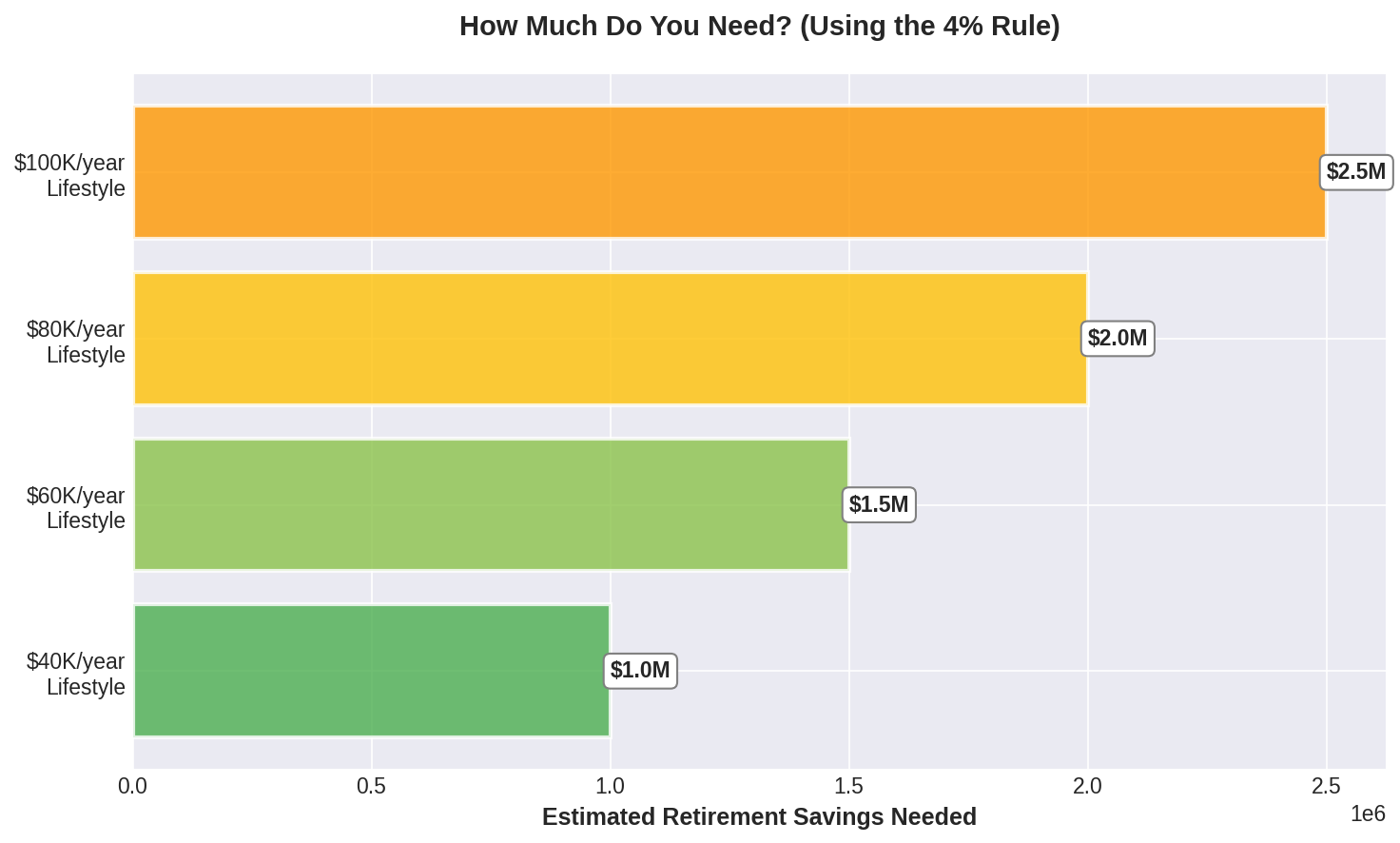

Rule of thumb: Take your desired annual retirement spending, subtract guaranteed income (pension + Social Security), then multiply the gap by 25. [^1]That's your target savings number.

But wait—before you panic or celebrate—let me explain why this number is different for federal employees, and how to calculate your specific target.

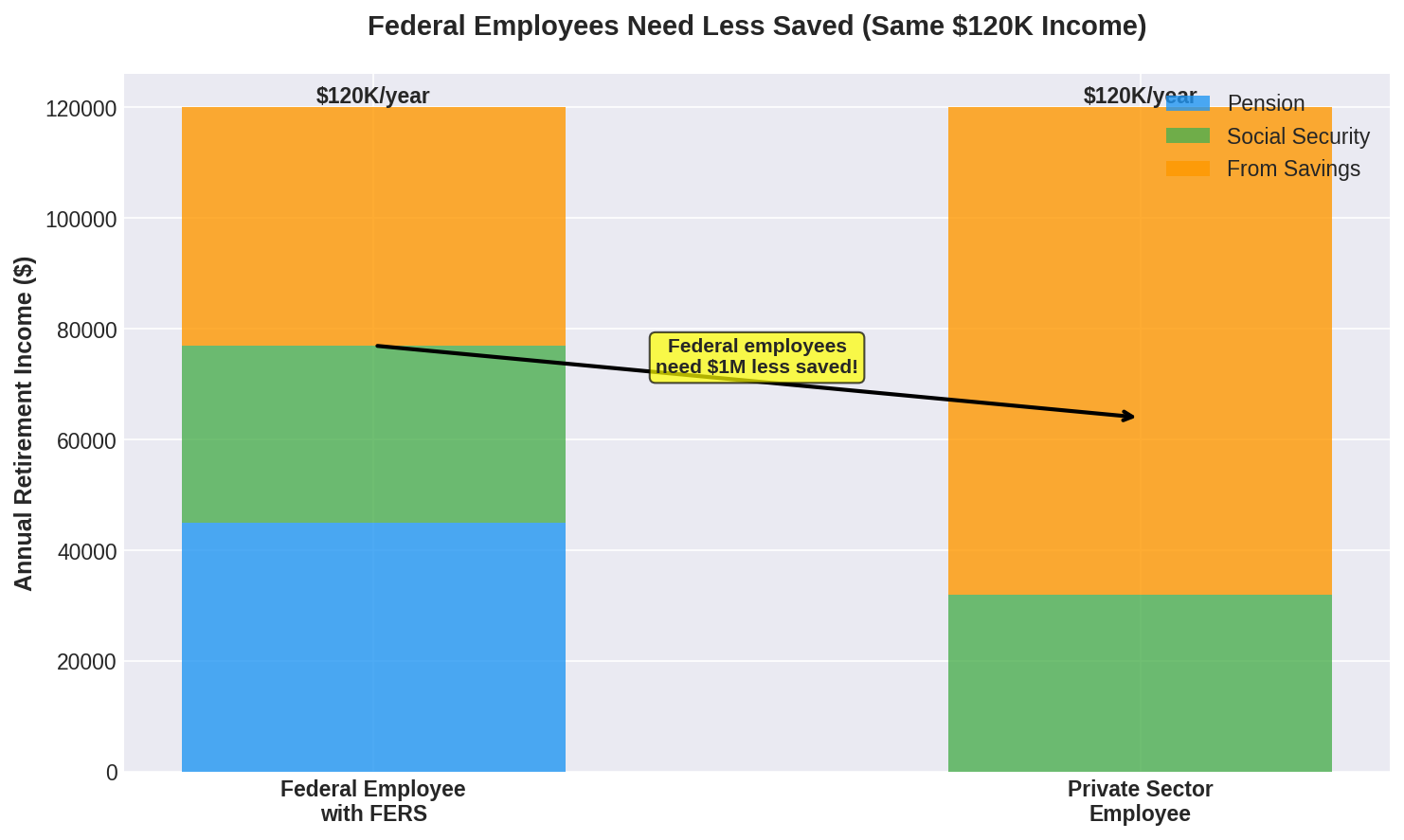

Why Federal Employees Need Less Than You Think

Here's the thing most retirement calculators get wrong: they're built for private sector employees who have to fund their entire retirement from savings and Social Security alone.

You? You have a FERS pension. That changes everything.

Example: Let's say you need $120,000/year in retirement.

Private sector employee:

• Social Security: $32,000

• Need from savings: $88,000/year

• Savings needed: $2.2 million (using 4% rule)

Federal employee:

• FERS pension: $45,000

• Social Security: $32,000

• Need from savings: $43,000/year

• Savings needed: $1.075 million

Same lifestyle. $1.1 million less needed.

This is why online retirement calculators often tell federal employees they're way behind—they don't account for your pension.

The Three Factors That Determine Your Number

Factor #1: Your Annual Spending in Retirement

This is the foundation. Not what you spend now—what you'll actually spend in retirement.

Some expenses go down:

• No more mortgage (for many)

• No commuting costs

• No work clothes, lunches out

• Kids are (hopefully) financially independent

Some expenses go up:

• Healthcare (before and after Medicare)

• Travel (you finally have time!)

• Hobbies and entertainment

• Helping kids/grandkids

Most retirees find they need 70-90% of their pre-retirement income.

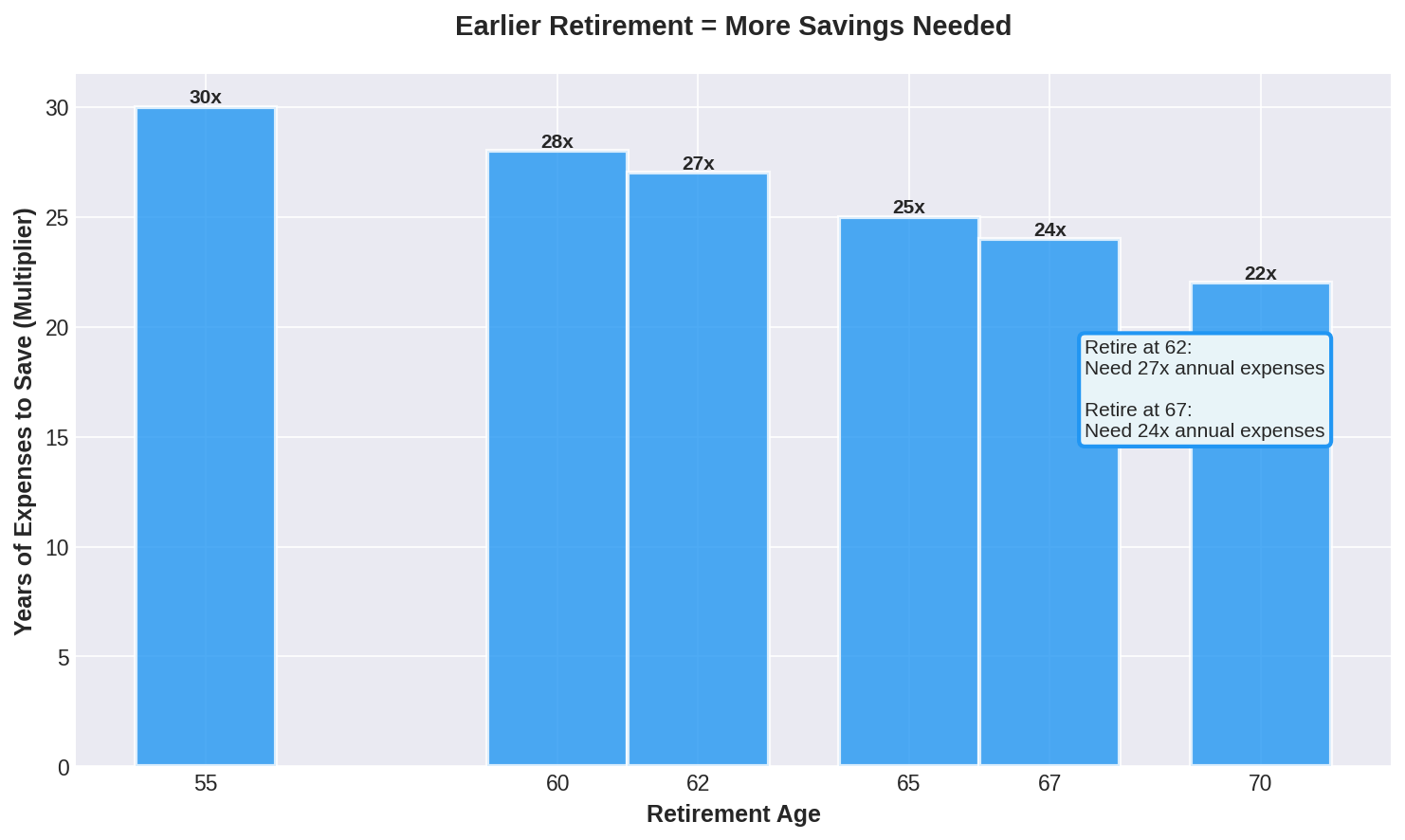

Factor #2: Your Retirement Age

The earlier you retire, the more you need. Simple as that.

Why? Three reasons:

1. Your money has to last longer

Retire at 62? Plan for 30-35 years of retirement. Retire at 67? Maybe 25-30 years.[^2]

2. Smaller FERS pension

Each year you work adds roughly 1% of your high-3 to your pension. Retire 5 years early? That's 5% less pension for life.

3. Reduced Social Security

Claim at 62 instead of waiting until 70? You're accepting 30% less per month for the rest of your life.

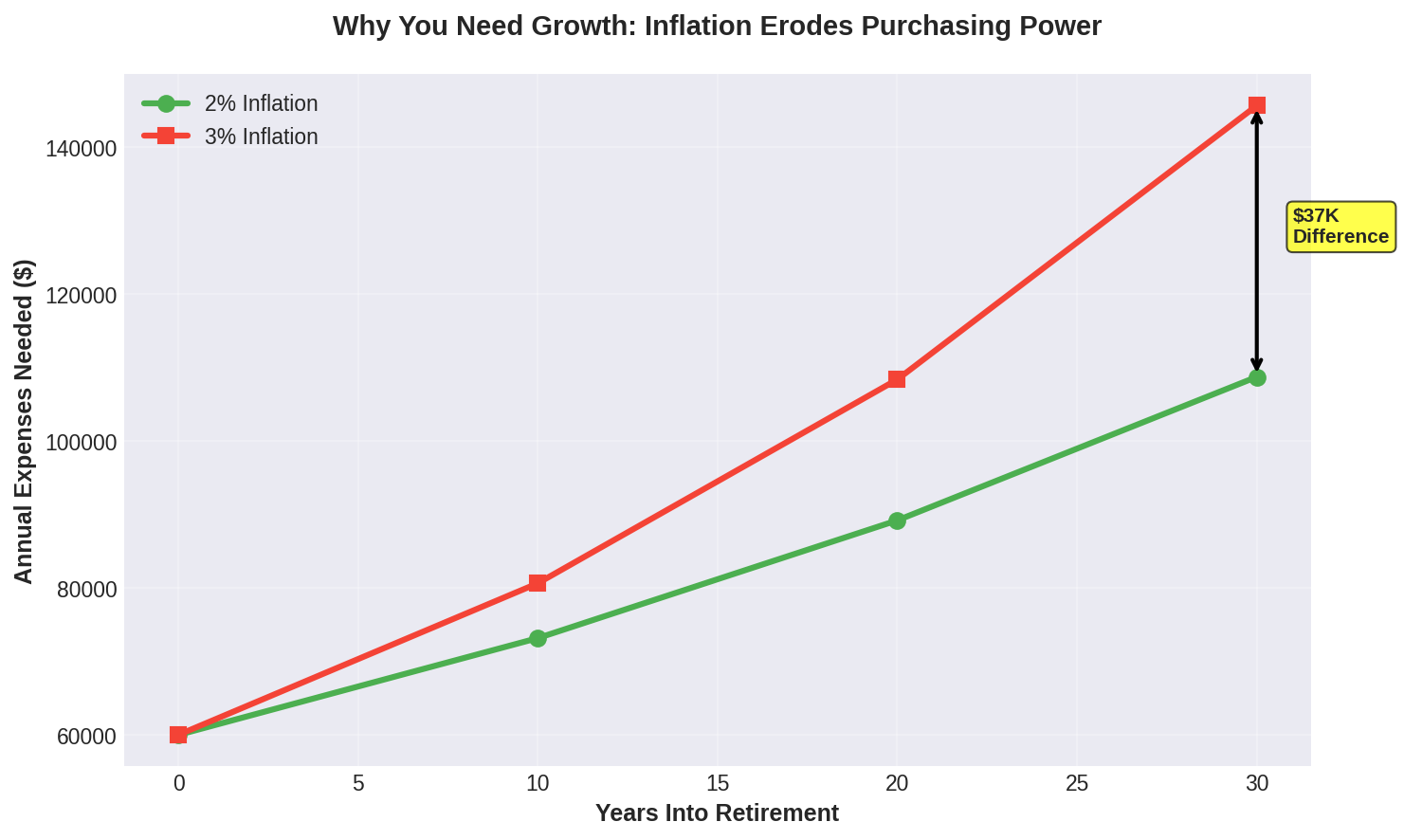

Factor #3: Inflation Over 30+ Years

This is the silent killer that most people ignore when planning retirement.

If you need $60,000/year today, in 30 years you'll need:

• At 2% inflation: $108,717

• At 3% inflation: $145,635

This is why you can't just live off bonds and CDs in retirement. You need growth to keep pace with inflation.

Your Personal Retirement Number: The Formula

Okay, let's calculate your actual number. Grab a calculator (or a piece of paper).

Step 1: Calculate Your Annual Expenses

How much will you spend per year in retirement?

Start with your current spending: $_____________

Subtract what goes away in retirement:

• Mortgage (if you'll pay it off): -$_____________

• TSP contributions: -$_____________

• Commuting costs: -$_____________

Add what increases:

• Healthcare (before 65): +$_____________

• Travel budget: +$_____________

• Other hobbies/goals: +$_____________

= Your annual retirement expenses: $_____________

Step 2: Calculate Your Guaranteed Income

FERS Pension:

Estimate: Years of service × 1% × High-3 salary

Example: 30 years × 1% × $150,000 = $45,000/year

Your FERS pension: $_____________/year

Social Security:

Check your estimate at ssa.gov/myaccount

Remember:

• Claim at 62: ~70% of full benefit

• Claim at 67: 100% of full benefit

• Claim at 70: 124% of full benefit

Your Social Security estimate: $_____________/year

Total guaranteed income: $_____________/year

Step 3: Calculate Your Gap

This is the money you need from your savings each year.

Annual expenses: $_____________

Minus guaranteed income: -$_____________

= Annual gap from savings: $_____________

Step 4: Calculate Your Target Savings

Take your annual gap and multiply by 25 (this is the 4% rule).

Annual gap × 25 = Your retirement savings target

Example:

Annual gap: $43,000

Multiply by 25: $43,000 × 25 = $1,075,000

Target savings: $1,075,000

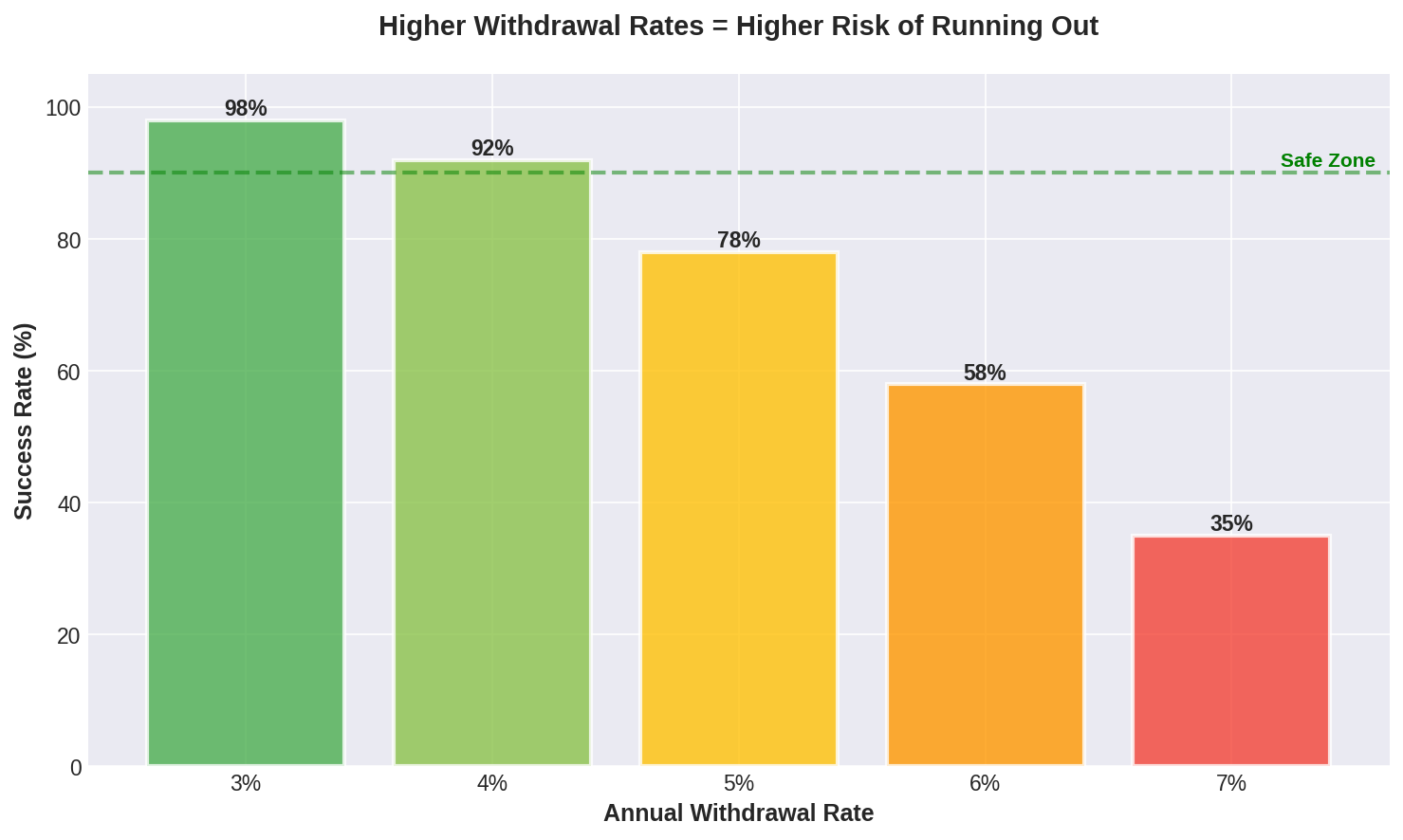

What Is the 4% Rule (And Should You Use It)?

The 4% rule says you can withdraw 4% of your portfolio in the first year of retirement, then adjust that amount for inflation each year, with a high probability your money will last 30+ years.

Why 4%? Research shows that historically, this withdrawal rate has succeeded 90-95% of the time, even through market crashes and recessions.[^3]

Should you use 4%?

For federal employees, I typically recommend:

• 4% is reasonable if you're balanced (Exp. 60/40 stocks/bonds)

• 3.5% is safer if you're more conservative or retiring very early

• 4.5% might work if you have flexibility and can cut back in down markets

The beauty of having a FERS pension? Even if your portfolio has a bad decade, your pension keeps coming. This gives you more flexibility than someone living entirely off savings.

Common Situations: What's Your Number?

Let me walk through a few typical scenarios so you can see how this plays out:

Scenario 1: The Frugal Retiree

Profile:

• Retired at 62 with 30 years of service

• High-3 salary: $100,000

• FERS pension: $30,000/year

• Social Security at 62: $22,000/year

• Annual expenses: $60,000

• Mortgage paid off

The math:

$60,000 expenses - $30,000 pension - $22,000 SS = $8,000 gap

$8,000 × 25 = $200,000 needed in TSP

Scenario 2: The Comfortable Retiree

Profile:

• Retired at 67 with 35 years of service

• High-3 salary: $140,000

• FERS pension: $49,000/year

• Social Security at 67: $35,000/year

• Annual expenses: $95,000

• Small mortgage: $1,500/month

The math:

$95,000 expenses - $49,000 pension - $35,000 SS = $11,000 gap

$11,000 × 25 = $275,000 needed in TSP

Scenario 3: The Lifestyle Retiree

Profile:

• Retired at 62 with 32 years of service

• High-3 salary: $160,000

• FERS pension: $51,200/year

• Waiting until 70 for Social Security: $48,000/year

• Annual expenses: $130,000 (lots of travel)

• Paid-off home

The math:

Ages 62-70 (before Social Security): $130,000 - $51,200 = $78,800 gap

Age 70+: $130,000 - $51,200 - $48,000 = $30,800 gap

Since the bridge years (62-70) have the highest needs:

$78,800 × 25 = $1,970,000 needed in TSP

Or use a more nuanced calculation accounting for the Social Security bump at 70, which might bring it closer to $1.5M.

"But I'm Behind... Now What?"

If you calculated your number and realized you're not there yet, don't panic. You have options:

Option 1: Work a Few More Years

Every extra year you work:

• Adds 1% to your FERS pension (for life)

• Lets your TSP continue growing

• Reduces the number of years your savings have to last

• Increases your Social Security benefit

Example: Working from 62 to 65 (just 3 extra years) could:

• Increase your pension by $4,500/year for life

• Let your $800K TSP grow to $950K (assuming 6% returns)

• Add $90K+ in new contributions

Option 2: Reduce Your Expenses

Sometimes the math is simple: if you need less, you need less saved.

Common reductions:

• Downsize your home (reduce taxes, maintenance, utilities)

• Move to a lower cost-of-living area

• Cut back on travel/dining out in the first few years

• Pay off the mortgage before retiring

Every $10,000 you can cut from annual expenses reduces your target savings by $250,000.

Option 3: Delay Social Security to 70

If you claim Social Security at 62 vs waiting until 70, you're leaving thousands on the table every year for the rest of your life.

Example:

• At 62: $24,000/year

• At 70: $42,000/year

That's an extra $18,000/year. Which means you need $450,000 less in TSP savings.

Plus, your FERS pension and TSP bridge the gap from 62-70, so you're not struggling during those years.

Option 4: Work Part-Time in Retirement

Not ready to stop working entirely? Many retirees find fulfillment (and income) in:

• Consulting in their field

• Part-time work they actually enjoy

• Seasonal work (think: tax prep, retail during holidays)

Even earning $15,000/year for the first 5 years of retirement can dramatically reduce the pressure on your portfolio.

The Bottom Line

So, how much money do you need to retire?

The formula is simple:

(Annual Expenses - FERS Pension - Social Security) × 25 = Your Savings Target

But the answer is personal:

• Some federal employees can retire comfortably on $500K

• Others need $2M+

It depends on:

• Your lifestyle expectations

• Your FERS pension amount

• When you claim Social Security

• Whether you have a mortgage

• Your health and longevity expectations

The good news? As a federal employee, you're starting from a better position than most Americans. Your FERS pension is a massive advantage that reduces how much you need saved by potentially $1 million or more.

Ready to get a precise answer for your situation?

At Allset Wealth, we specialize in helping federal employees calculate their exact retirement number and build a plan to get there. We'll look at your FERS pension, TSP, Social Security, and create a comprehensive roadmap tailored to your goals.

Because "enough" isn't a guess—it's a number. Let's find yours.

[^1] Bengen, W.P. (1994). Determining Withdrawal Rates Using Historical Data (Journal of Financial Planning; PDF via Financial Planning Association).The “Rule of 25” is the flip side of the 4% rule (because 1 ÷ 0.04 = 25)

[^2] SSA’s 2022 Period Life Table (used in SSA’s Trustees reporting context) shows remaining life expectancy values by exact age. For example, at age 62 remaining life expectancy is about 19.6 years (male) and 22.5 years (female); at age 67 it’s about 16.1 years (male) and 18.6 years (female). Many plans use longer horizons (e.g., 25–35 years) to manage longevity risk.

[^3] Financial Planning Association (Journal). Updating the Trinity Study / sustainable retirement spending (notes 4% survived in ~95% of rolling 30-year periods for a 50/50 portfolio).

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Consult qualified financial professionals who understand federal benefits and your complete financial situation. Federal benefits and regulations are subject to change.